Homeownership “Need to Knows” for Military Families

Credit: UF/IFAS

Introduction

Everyone needs a place to live, whether they own their dwelling or rent it, and military families are no exception. One way that they differ from civilians, however, is that they make housing decisions more frequently. Military families move, on average, every 2.5 years when service members receive permanent change of station (PCS) orders.

Buying a home is the largest purchase most people ever make, and unwise purchase decisions can cost thousands of dollars. Common errors include failure to shop around for a mortgage, insufficient negotiation for the purchase price, and no contract contingency clause for results of a professional home inspection. This publication discusses:

- General information about home buying: terminology

- General information about home buying: mortgage financing and insurance

- Military-specific housing decisions: rent or buy?

- Military-specific home buying: financing options

- Military-specific home buying: disabled veterans’ benefits

- Five home-buying tips for military families

- Homeownership resources

General Information about Home Buying: Terminology

Below are descriptions of common terms used in discussions about homeownership.

Appraisal: An unbiased estimate made by a real estate professional of the fair market value of a home for sale. It is one of many closing costs that potential buyers must pay. Appraisals are typically required by mortgage lenders to ensure that prospective borrowers are not getting a loan that exceeds the value of the home.

Contingency clauses: Language written into a home purchase offer stating conditions that must be met for a sale to proceed. Common contingencies are a “clean” inspection with no major issues and a borrower’s qualification for a mortgage.

Equity: The difference between a home’s current value and its outstanding mortgages. Equity increases in two ways: by an increase in the value of a home (due to home improvements, inflation, and local supply and demand factors), and as steady repayment of a mortgage over time reduces indebtedness. As an example, a home valued at $350,000 with a $300,000 mortgage has $50,000 of equity.

Leverage: The use of someone else’s (e.g., a bank) money to magnify the gain (or loss) on an investment. A common example is homeownership. If someone buys a home for $200,000, puts 20% ($40,000) down and borrows $160,000, and the house is worth $400,000 in 10 years, its value will be 10 times more than the owner’s original outlay.

PITI: An acronym used to describe components of a home mortgage borrower’s monthly payment: principal (i.e., amount owed), interest, taxes (i.e., property taxes), and insurance (i.e., homeowners insurance). PITI is a key number in ratios used to determine home affordability and qualification for a mortgage.

Principal prepayment: The process of sending extra money to a mortgage lender to apply toward principal remaining on a loan. The benefit of prepaying principal is that the amount of interest owed and the time that it takes to completely pay off a mortgage are reduced. Prepayment often saves tens of thousands of dollars compared to paying only the required amount of monthly principal and interest. It makes the most sense when the interest rate paid on the mortgage is higher than potential earnings on investments.

Purchase offer: A detailed document submitted by a potential home buyer to a seller, often via a real estate agent, as the first step in the home-buying process. Purchase offers are often amended during the process of negotiating the sale price, earnest money (a buyer’s deposit), included furnishings, contingencies, and other factors.

General Information about Home Buying: Mortgage Financing and Insurance

To determine how much money they can borrow and, therefore, how much “home” they can afford, it is smart for potential homeowners to get pre-qualified for a loan. This means that a lender provides an estimate of how much the prospective buyer could borrow based on preliminary financial data (e.g., income, assets, existing debt). Even better is preapproval, where financial data (e.g., credit report, pay stubs, tax return) are verified and maximum loan amounts are more official and credible as a factor for home sellers to consider.

Most lenders follow two basic guidelines to determine how much borrowers can afford:

- Front-end ratio: Monthly payment for PITI should not exceed approximately 28% of gross monthly income.

- Back-end ratio: Monthly payment for PITI plus all consumer debts (e.g., credit cards, student loan, car loan, and long-term obligations such as child support) should not exceed approximately 36% of gross monthly income.

As an example, if a two-paycheck military family earning $72,000 per year applies for a mortgage, their maximum monthly mortgage payment (PITI) would be limited to $1,680 ($6,000 x .28) with the front-end ratio. However, if they also have a $500 monthly car payment and $300 in monthly credit card payments ($800 total), the mortgage payment would be limited to $1,360 ($6,000 x .36 = $2,160; subtract $800). Many lenders only consider the back-end ratio when approving loans because it is more conservative and a better indicator of creditworthiness. Specific mortgage ratio standards vary among lenders.

The second ”I” in PITI is for homeowners (HO) insurance. The most important figure in a HO insurance policy is the amount of insurance carried on a dwelling (i.e., house) because other property loss limits (e.g., for a free-standing garage or shed) are usually stated as a percentage of it. Most insurers require that a home be insured for at least 80% of its full replacement cost to be considered fully insured. Dwelling coverage should also adjust periodically for inflation when a policy is renewed. Certain risks (e.g., earthquakes and floods) are not covered by standard HO insurance policies and require special coverage.

Most homeowners pay for HO insurance and property taxes via an escrow account. This is an account set up by mortgage lenders to hold the taxes and insurance portions of monthly PITI payments until bills come due. Several months of “T” and “I” payments may be required to “seed” the escrow account when it is first established. This is just one of many closing costs that buyers will be required to pay before a home becomes theirs.

Military-Specific Housing Decisions: Rent or Buy?

All potential homeowners weigh the choice of renting versus buying a home. Importantly, military families move frequently, and often without a lot of advance notice, according to PCS orders. The need to sell a home quickly is a concern, as is simple math: will a house be owned long enough to recoup closing costs and other expenses? The table below compares key features of renting versus buying.

Renting provides the most flexibility for military families. They can simply pick up and leave, at most losing their security deposit(s). For example, if a service member gets deployed, the at-home spouse might decide to move back in with family members for social support (e.g., child care) and to save money that would otherwise be spent on rent, utilities, and other housing expenses. Rental agreements may be able to be ended early for deployments lasting 90 days or longer under the Servicemembers Civil Relief Act. Some rental units also provide amenities (e.g., pool, gym) that families on a limited budget could not purchase on their own.

Nevertheless, an estimated 43% of active duty service members own a home, and veterans have higher homeownership rates than the general population (Strochak, Choi, & Goodman, 2020). Service members address the challenges of frequent moves with strategies such as becoming landlords for former homes and “geo-baching” (i.e., where married service members move to a new PCS location and live apart from their families).

Military-Specific Home Buying: Financing Options

There are mortgage financing options available to military families that are not available to civilians. Two commonly used programs are Veterans Affairs (VA)-guaranteed loans and the Military Housing Assistance Fund (MHAF) that provides help to eligible service members and veterans with paying closing costs.

Compared to traditional mortgages for civilians, VA mortgages include favorable financing terms including competitive interest rates, limited closing costs, and no down payment or mortgage insurance (i.e., PMI). Instead, eligible applicants apply for a mortgage with a private lender and the government provides a guarantee of at least 25% of the amount borrowed to compensate lenders for the risk of no down payment.

VA loans help service members, veterans, and eligible reservists to obtain, retain, adapt, or refinance a home. Various eligibility requirements apply, such as 24 continuous months of active duty and various length of service requirements for Reserve and National Guard members. Service members must present a certificate of eligibility (COE) from the VA to a lender to prove that they qualify for a VA-backed loan. Most importantly, applicants must qualify for a loan from the lender based on their credit history and the debt-to-income ratios described above.

Credit: Kristen Jowers

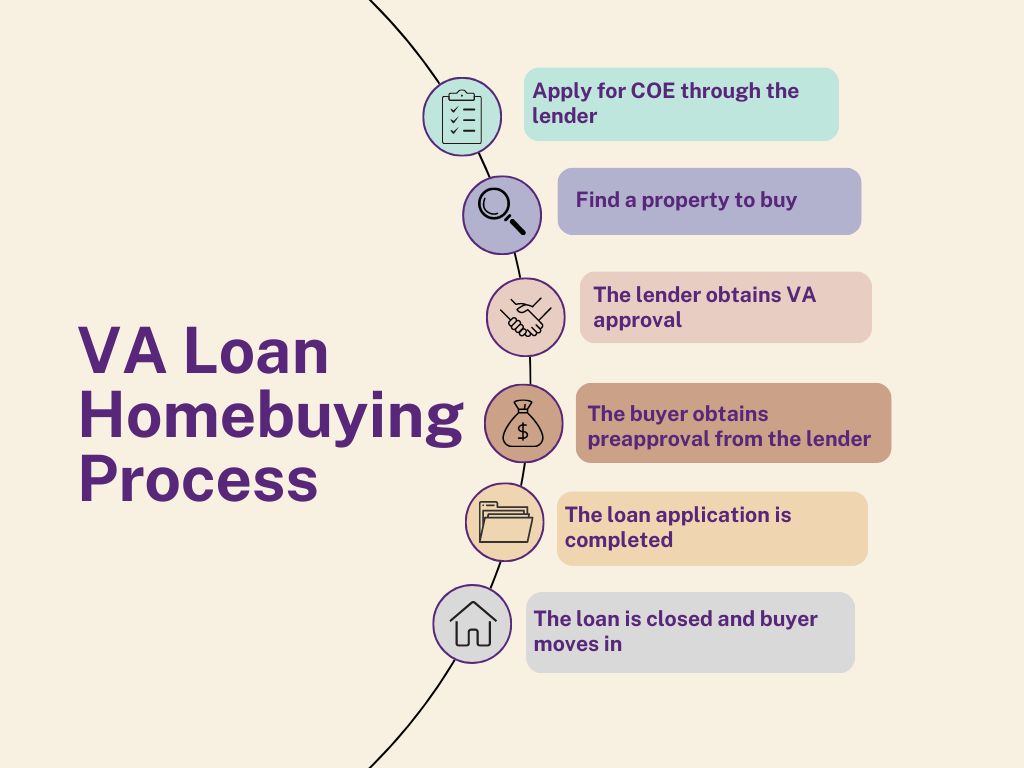

Steps in the VA loan process are listed below.

- Apply for a COE through the lender.

- Find a property to buy.

- The lender obtains VA approval.

- The buyer obtains preapproval from the lender.

- The loan application is completed.

- The loan is closed, and buyers take possession of the home.

VA mortgage benefits never expire (i.e., they can be used more than once), and VA mortgages are assumable, which is a great benefit in times of rising interest rates when a veteran can take over an existing low-rate mortgage.

Over 1,200 lenders participate in the VA loan program, which has one of the lowest foreclosure rates in the industry in recent years. This is very impressive considering its zero-down-payment option and no mortgage insurance. When market interest rates drop, the VA also offers an interest rate reduction refinancing loan (IRRRL) to help homeowners reduce their interest rate. There is also a cash-out refinance loan for homeowners to borrow against available home equity.

One of the biggest obstacles for potential homeowners, military or civilian, is out-of-pocket closing costs. The MHAF helps eligible service members and veterans cover this expense by negotiating concessions from home sellers and gifting the remainder of closing costs from MHAF funds. The gifted money is free and never has to be repaid.

Another source of mortgage financing for veterans and service members is a Military Choice loan, typically used by service members who are not eligible for a VA loan. Interest rates are typically higher than those of VA loans, but lower compared to those of conventional loans. Additionally, little to no down payment is required. Like VA loans, at least one borrower on a Military Choice loan must be active duty or a reservist or veteran. Military Choice loans are available through Navy Federal Credit Union (NFCU), which serves the broad military community (service members, veterans, Department of Defense personnel, and family members). NFCU currently has about 12 million member-owners. Other alternatives to VA and Military Choice loans are USDA and FHA loans and conventional mortgages.

Military-Specific Home Buying: Disabled Veterans Benefits

Additional housing benefits are available for disabled military veterans. Disabled veterans do not have to meet the minimum service requirement to qualify for a VA loan. In addition, disabled veterans may be eligible to receive grants to purchase or construct an adapted home or modify an existing home for accessibility.

There are three different grants that eligible veterans can use: Specially Adapted Housing (SAH), Special Housing Adaptation (SHA), and Temporary Residence Adaptation (TRA). Disabilities that qualify veterans for funding include blindness, limb amputation, and severe burns. In addition, some states have grants or tax breaks for disabled veterans (e.g., income and property tax exemptions).

Five Home-Buying Tips for Military Families

- Develop contingency plans. Given the mobility of military families, contingency plans for relocation or deployment are critical for homeowners to avoid a significant financial loss and the stress of being “torn between two houses.” Possible solutions include short selling (i.e., selling a house with an asking price less than the mortgage balance), becoming a “long-distance landlord,” geo-baching, and marketing a home to receive quick cash offers. A good source of information and help with the logistics of selling or renting a house quickly is the relocation assistance staff at military installations.

- Know the guidelines. According to the federal government Military Consumer website, homeowners should cap the cost of a home at 2 to 2.5 times their annual income. Monthly payments should not exceed 35% of income. Applying these percentages, a military family earning $50,000 should look for a home costing no more than $125,000 and make monthly payments no higher than about $1,458 ($4,167 of income per month x .35). When homebuyers “know their numbers,” they can make better housing decisions.

- Study housing markets carefully. As realtors are fond of saying, a key factor in the cost of homes is “location, location, location.” Therefore, it is very important for relocating military families to learn about the local housing market into which they are moving and its local issues. This can be done via an online subscription to newspapers, reliable websites, and/or social media. It is also important to pay attention to Federal Reserve actions and whether mortgage interest rates are headed up or down.

- Prioritize housing needs. A useful exercise, when searching for a new residence to buy (or rent), is to make three lists: essential “must-have” items; “like to have” items that are nice, but not necessary; and “don’t want” items that should be avoided. Examples might be three bedrooms and air conditioning (must-haves), a dining room (like to have), and a long commute and a swimming pool (don’t want). Take notes during home visits to supplement information available online. Make several return visits to homes of interest, if possible.

- Avoid homebuyer regrets. Common regrets expressed by people who did not do sufficient financial planning or due diligence before buying a home are listed below.

- Initiating a purchase with insufficient funds for closing costs and other expenses.

- Buying a home that is too expensive to maintain.

- Finding out that a house “has issues” or is poorly built.

- Decrease in property value due to location-specific factors.

- A decrease in family income that made mortgage payments a burden.

- Home layout and features were not examined thoroughly.

- Dissatisfaction with a neighborhood or the length of a commute to work.

Homeownership Resources and References

Consumer Financial Protection Bureau. (2022). What is a Debt-to-Income Ratio? https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-en-1791/

Department of Defense Office of Financial Readiness. (n.d.-a). Amortizing Loan Calculator. https://finred.usalearning.gov/ToolsAndAddRes/Calculators/Loan/calculator/Amortizing-Loan

Department of Defense Office of Financial Readiness. (n.d.-b). Housing Calculators. https://finred.usalearning.gov/ToolsAndAddRes/Calculators/Housing

Federal Trade Commission, U.S. Department of Defense, & Consumer Financial Protection Bureau. (n.d.). Buying a Home - Active Duty. https://www.militaryconsumer.gov/spend/your-home/buying-home-active-duty

Freddie Mac. (n.d.). Glossary of Terms. https://myhome.freddiemac.com/resources/glossary

Friedman, R. A. (2023). Not Your Grandparents’ VA Loan. The Wall Street Journal. https://www.wsj.com/articles/v-a-mortgages-3bddb71b

Lightfoot, L. (2022). Geobaching Through the Holidays. https://blog-brigade.militaryonesource.mil/2022/12/06/geobaching-through-the-holidays/

Military Housing Assistance Fund. (n.d.). Closing Cost Assistance for Military and Veteran Families. https://usmhaf.org/

Military OneSource. (2022a). The Department of Veterans Affairs Home Loan Basics. https://www.militaryonesource.mil/transition-retirement/transition-to-civilian-life/the-department-of-veterans-affairs-home-loan-basics/

Military OneSource. (2022b). Use These 10 Calculators to Answer Your Biggest Home Financing Questions. https://www.militaryonesource.mil/housing-life/off-base-housing/use-these-10-calculators-to-answer-your-biggest-home-financing-questions/

Navy Federal Credit Union. (2023). Military Choice Loan. https://www.navyfederal.org/loans-cards/mortgage/mortgage-rates/military-choice-loan.html

OneOp. (2023). Military Home Buying Basics and VA Loans. https://oneop.org/learn/142466/

Pioneer Service Foundation. (2004). Personal Finance for Military Families. https://bookshop.org/p/books/personal-finance-for-military-families-pioneer-services-foundation-presents-inc-pioneer-service/8711137

Strochak, S., Choi, J. H., & Goodman, L. (2020). The Impacts of Military Service on Homeownership and Income. Housing Finance Policy Center. https://www.urban.org/sites/default/files/publication/101495/the_impacts_of_us_military_service_on_homeownership_and_income.pdf

U.S. Department of Veterans Affairs. (2023). VA Housing Assistance. https://www.va.gov/housing-assistance/